Our product team is taking SparcPay's functionality to the next level with Version 2.24:

-

- The menu logo has been updated to reflect our new SparcPay branding.

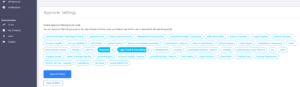

- The app now supports different approvers for different expenses. This is implemented by selecting Users, selecting Edit User and then scrolling down to Approver Settings and enabling "Approval Filtering by GL code". By default no filter is selected, but by clicking the appropriate GL accounts the approver will only see the expenses for those codes. In the example below the approver will only see "Insurance", "Legal, Audit and Accounting" and Management":

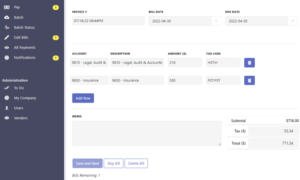

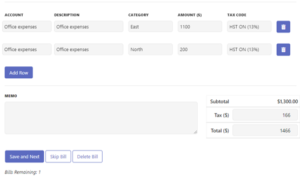

- On the Edit Bills screen the tax code is now selectable by line item, allowing a mix of line items with different tax rates. Note that the total tax on the invoice will be validated against the sum of the tax by line item per the selections. UPDATE: For corporations that do not track HST the total tax will not be validated as it is added back to the line items. This simplification reduces data entry in these cases.

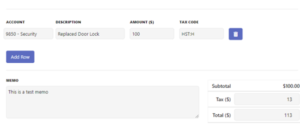

- Previously, with certain accounting systems the numeric GL code had to be preserved in the description field of the Edit Bills screen in order for it to be displayed to approvers. Now the Description can be completely custom, and the numeric GL code will be displayed in addition to the GL name and the custom description. With this keyed on the Bill Edit Screen:

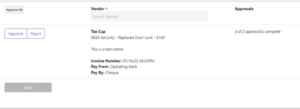

This will display on the Approval screen:

This will display on the Approval screen:

- With QBO, SparcPay can now connect and work with a company that does not have any sales taxes set up. Note that any applicable tax on SparcPay bills will be added to the line item.

- When using End-to-End Automation with QBO or QBD, SparcPay now supports expense categories (called Classes in QuickBooks). In the example below the Office Expenses are allocated to the East and North divisions:

- When using End-to-End Automation with QBO, SparcPay now works with Tax Groups that combine tax rates (e.g. GST/QST in Quebec).

- Plus additional changes to enhance performance and security.

- The menu logo has been updated to reflect our new SparcPay branding.